Twelve teams of graduate students advance to the final round of the 2020 Kellogg-Morgan Stanley Sustainable Investing Challenge.

Each year, the Kellogg-Morgan Stanley Sustainable Investing Challenge offers graduate students from around the world the opportunity to pitch innovative financial and investing ideas that help address critical social and environmental issues.

This year, Northwestern University’s Kellogg School of Management celebrates a decade of hosting the Challenge and fostering exciting innovations in sustainable investing. As lead sponsor of the event for the last seven years, Morgan Stanley's Institute for Sustainable Investing has been a proud supporter of the Challenge and looks forward to continuing to build sustainable investing capacity for the next generation of finance professionals.

Ninety-five teams from around the world submitted proposals this year, seeking to improve everything from pandemic response capabilities in Nigeria to agricultural plastic waste reduction in the U.S. Twelve finalist teams have been chosen to present their ideas at the final event, where the winning team will receive $10,000. New in 2020, and as part of the Morgan Stanley Plastic Waste Resolution to help prevent, reduce and remove 50 million metric tons of plastics waste from the environment, proposals that seek to address the issue of plastic waste will be eligible for an additional prize of $5,000.

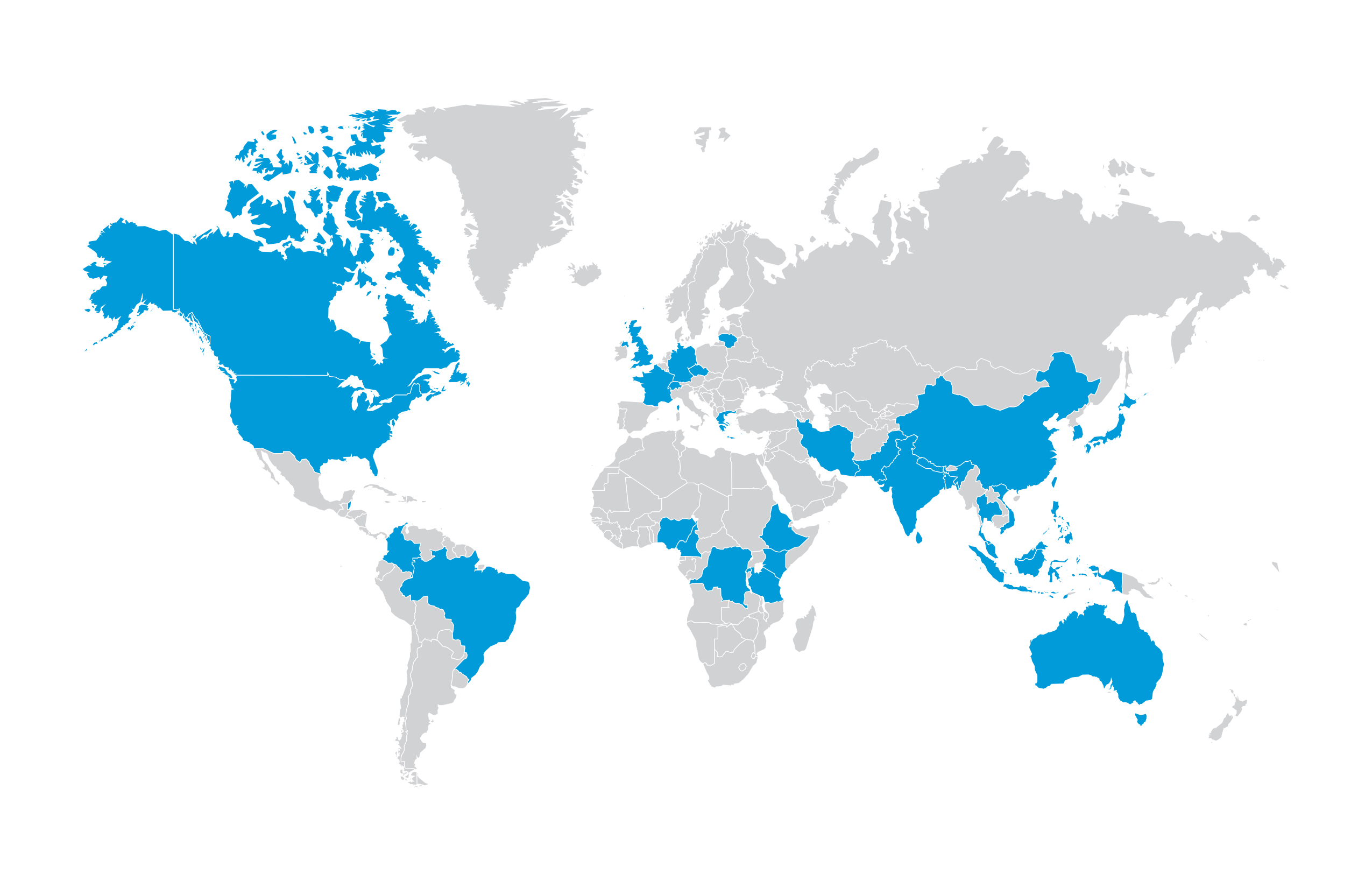

This year’s competition drew a more diverse group of participants than ever: 308 students from 56 different countries submitted investment prospectuses targeting sustainability and impact challenges in 34 countries. The volume of proposals and the breadth of the problems they aim to address underscores that a new generation of investment leaders view finance as a critical tool for helping solve global challenges.

| PROPOSED PROJECTS IN | FROM ACROSS | BASED IN |

| 34 | 74 | 56 |

| COUNTRIES | SCHOOLS | COUNTRIES |

| TOTAL OF | FORMING | NARROWED TO |

| 308 | 95 | 12 |

| STUDENTS | TEAMS | FINALISTS |

The Finalists

This year’s finalists are:

Australian Distributed Energy Resource Backed Securities (AusDERBS)

Proposal: Asset backed security (ABS) designed to bundle income streams from assets related to renewable energy and energy efficiency.

School: Cranfield University School of Management

Carbon Option+

Proposal: Call option contract that aims to help compliance and voluntary carbon offset buyers hedge the risk of overpaying for carbon credits to meet their emission reduction goals.

School: Duke University Nicholas School of the Environment

CEESCO - Unlocking energy efficiency in Central and Eastern Europe

Proposal: Fund designed to help increase energy efficiency in buildings by providing energy saving companies (ESCOs) with liquidity from green bond proceeds.

School: INSEAD

Consolidate-And-Recycle (CARe) Fund

Proposal: Private debt and equity fund that aims to provide communities with more affordable recycling opportunities through investments in the growth and expansion of small companies across the waste management value-chain.

School: University of Rochester, Simon School of Business

Dignity Bond

Proposal: Outcome-based security designed to help eradicate homelessness through investments in the development of purpose-built social housing.

School: ESADE Business School; London School of Economics

Fund for Adopting Responsible Materials (FARM)

Proposal: Loan fund that aims to help reduce agricultural plastic waste by linking farmers and biodegradable mulch producers though an input credit program.

School: Tufts University, The Fletcher School of Law and Diplomacy

Locus Agriculture

Proposal: Real assets fund that aims to invest in arable land to help improve rural farmers’ quality of life by employing landless farmers to cultivate high margin cash crops through modern agricultural techniques.

School: Indian Institute of Management, Ahmedabad

The PlastiCity Fund

Proposal: Loan fund designed to help reduce plastic waste by financing effective, innovative and scalable plastic sorting technologies.

School: Northwestern University, Kellogg School of Management

Refugee ETF

Proposal: Exchange-traded fund designed to help drive economic integration of refugees through investments in a global index comprised of listed companies with robust refugee-focused policies and initiatives.

School: New York University, Stern School of Business; New York University, Wagner School of Public Service

SeaLess Plastic Fund

Proposal: Private debt and equity fund that seeks to help reduce plastic waste through investments in the seaweed-based bioplastics value chain.

School: Columbia University Graduate School of Arts and Sciences; University of Crete

SWEEPCO BONDS

Proposal: Green municipal revenue bond designed to help reduce plastic waste by upgrading existing municipal waste management facilities and improving local recycling infrastructure.

School: Columbia University, Columbia Business School

Waste2Worth Fund

Proposal: Waste management infrastructure-focused private equity fund that aims to help reduce compostable waste.

School: Imperial College Business School